Finally – When payment could occur!

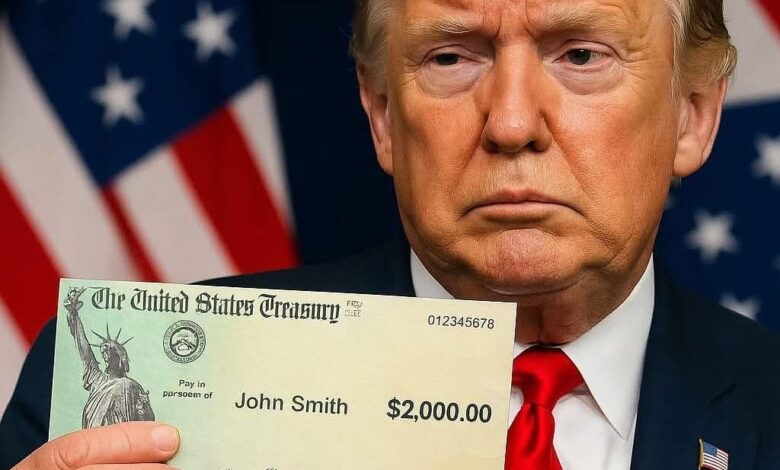

When Donald Trump floated his latest economic proposal on Truth Social, it hit like a grenade tossed into an already volatile political landscape. No vague hints, no slow rollout — just a bold declaration: a nationwide dividend of at least $2,000 per person, funded entirely by tariffs.

No income requirements announced. No bureaucratic maze. Just a promise to send cash straight to American households — with high-income earners excluded — paid for by foreign exporters who want access to the U.S. market.

It’s a simple pitch, and politically, it’s dynamite.

Trump framed it as another “America First” maneuver: stop squeezing citizens with income taxes and start squeezing foreign producers instead. According to him, this shift doesn’t weaken the country — it strengthens it. In his post, he dismissed critics outright, calling anyone who doubts the power of tariffs a “fool,” and reminding supporters that under his leadership, the U.S. was “the richest, most respected country in the world,” with strong markets and lower inflation.

But beyond the sound bites, America is left staring at a giant unanswered question: Could this actually work?

Right now, the outline is bare bones. No clear eligibility system. No payment schedule. No explanation of whether this becomes a yearly dividend, a quarterly rebate, or something tied to tax filings. It’s a political vision, not a finished policy — but even a loose sketch can tell you plenty.

Here’s the core idea: impose tariffs on imported goods; collect massive revenue; redistribute a portion back to Americans. In theory, foreign exporters “pay.” In reality, tariffs are never that neat — they ripple through the economy, changing prices, shifting supply chains, and stirring up trade partners who generally don’t sit quietly when hit with new costs.

Economists watching this proposal are bringing up the closest real-world comparison: the Alaska Permanent Fund. Alaska taxes its own natural resources — mainly oil — and gives residents an annual payment. Some years it’s a few hundred dollars, some years it’s over $2,000. It works because Alaska has a lucrative, highly profitable resource that the state itself controls.

For Trump’s plan to mirror that, tariffs would have to become the new oil. The U.S. would need an enormous influx of import revenue — far beyond what current tariff levels provide.

Right now, tariffs make up a small slice of federal income. Income taxes — the ones Trump wants to eliminate — account for more than half. To replace that with tariffs alone, the numbers would need to multiply dramatically. Higher tariffs could, in theory, bring in more revenue, but they can also tank imports, drive up domestic prices, and trigger retaliation from other nations. It’s a balancing act with consequences on all sides.

But the idea taps into something powerful: the deep resentment many Americans feel toward the tax system. For decades, people have equated April 15th with frustration, bureaucracy, and the sense that they’re paying into a machine that gives them little in return. Trump’s message hits that nerve directly. Eliminate income tax? Replace it with foreign-funded dividends? To many people, that sounds like justice.

Whether it’s economically realistic or not, it’s politically effective — and Trump knows it.

Supporters love the idea of foreign companies “paying their share.” They see tariffs as a way to push back against globalization and protect American jobs. They hear “$2,000 per person” and picture relief hitting their bank accounts.

Critics, meanwhile, see the opposite: trade wars, higher consumer prices, and an unstable revenue source being asked to fund one of the largest government programs ever imagined. They worry it’s a campaign promise built on fantasy math. They point out that tariff-heavy economies often deal with inflation spikes and strained diplomatic ties.

Still, the proposal doesn’t exist in a vacuum. It fits the pattern Trump has leaned on for years: bold economic nationalism, simple messaging, and a willingness to upend traditional policy structures. No matter how analysts react, millions of voters hear one thing — money in their pockets.

The unknowns are where this gets interesting. For example:

Would the dividend be automatic, or require tax filings?

Would the amount fluctuate with tariff revenue?

Would the payments be monthly? Yearly? One-time?

How would the government ensure the revenue stream is stable enough for consistent payouts?

And if income taxes truly disappeared, what happens to Social Security, Medicare, and the countless programs funded by those taxes?

These questions aren’t minor details — they’re the backbone of the entire system. But none of them have answers yet.

The political world is watching closely because this proposal, if ever implemented, would reshape the U.S. economy more radically than almost any policy in modern history. A tariff-funded citizen dividend would be unprecedented in scope and impact.

To Trump’s supporters, it sounds like the government finally working for the people rather than against them. To skeptics, it sounds like a risky gamble dressed up as a populist gift.

Right now, it’s neither reality nor law — just an idea. But it’s an idea with enough force behind it to dominate headlines and ignite debate across the country.

In the end, Trump’s message is clear: foreign producers should pay more, and American families should benefit directly. How that vision survives contact with Congress, trade partners, and economic math remains to be seen.

For now, the country is left with a provocative possibility: a “tariff dividend” that redirects national revenue toward households instead of the IRS. Whether it’s feasible or not, it’s already shaping the conversation about what the next era of U.S. economic policy could look like.

And as with most big political promises, the real story won’t be the announcement — it will be what happens when someone actually tries to make it real.